Roth ira balance by age

Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need. Save for Retirement by Accessing Fidelitys Range of Investment Options.

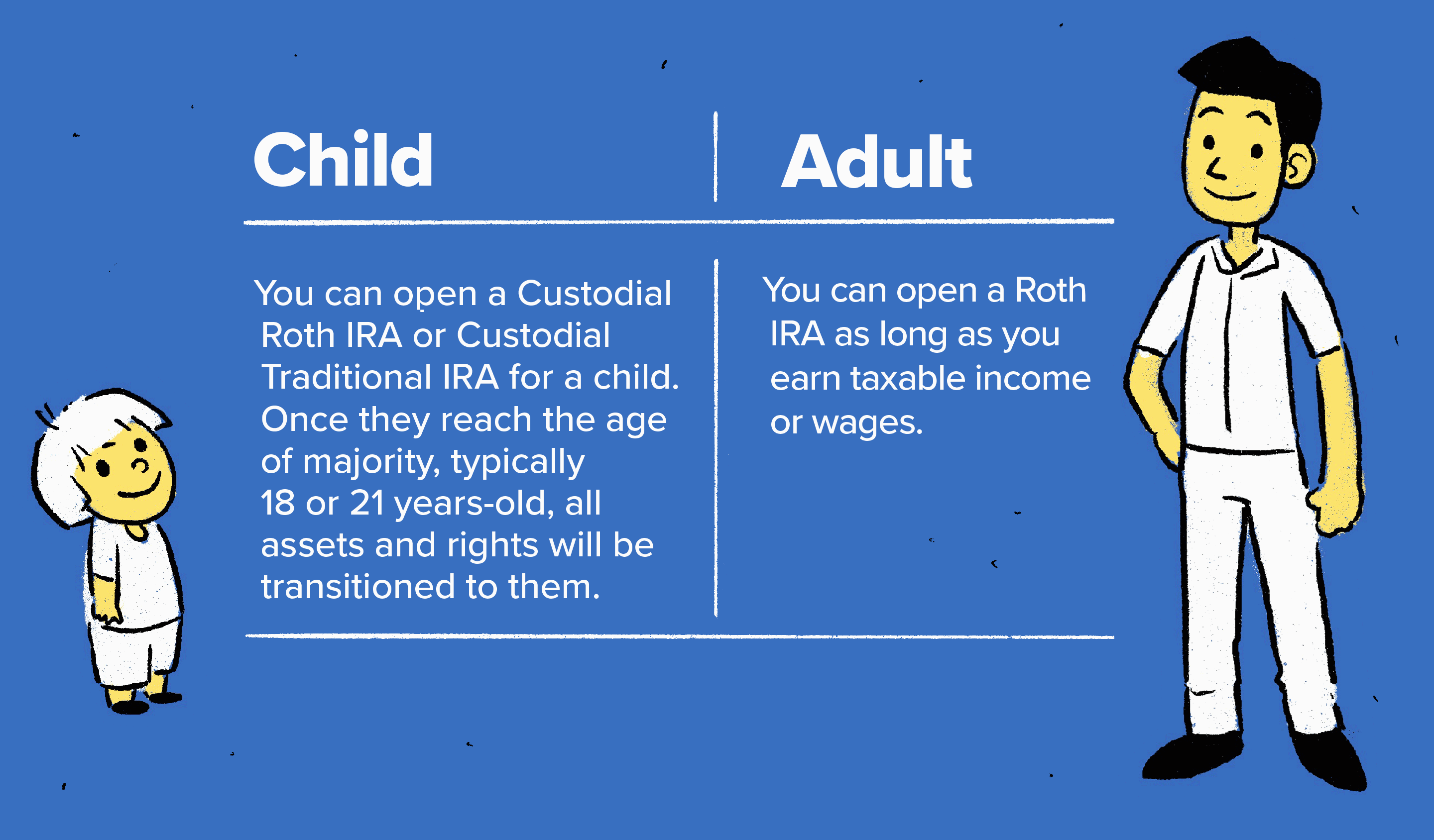

Ira Balance By Age

Roth owners had the lowest average and median balance at 14056 and 7319.

. You generally have to start taking withdrawals from your IRA SEP IRA SIMPLE IRA or retirement plan account when you reach age 72 70 ½ if you reach 70 ½ before January 1 2020. The amount you can add to a Roth IRA is further restricted by your modified adjusted gross income MAGI and your tax filing status. How much can an IRA be worth.

Compare 2022s Best Gold IRAs from Top Providers. Beginning in 2009. Yes designated Roth 401 k accounts as they are called are subject to required minimum distributions RMDs starting at age 72 unless the account owner is still working.

The regular Roth IRA rules apply meaning you dont have to take RMDs. Roll Over Into A TIAA Roth IRA Get A Clearer View of Your Financial Picture. Also there is no requirement for when you must begin withdrawing money from a Roth IRA.

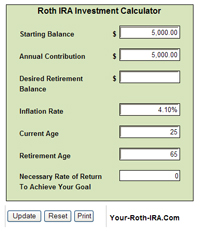

For example if you contributed to your Roth IRA in early April 2020 but designated it for the 2019 tax year youll only have to wait until Jan. The total annual contribution limit for the Roth IRA is currently 6000 with an additional catch-up contribution of up to 1000 allowed for people 50 or older. Open a Roth IRA by 101022 fund with 25K or more in new money to qualify.

Ad Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today. The current balance of your Roth IRA. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments.

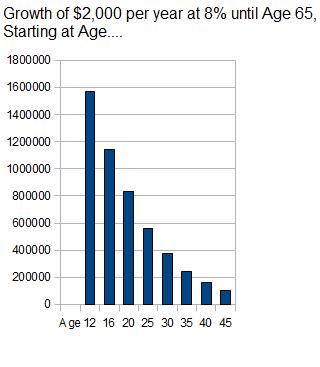

For example if you commit to contributing 6000 to a Roth IRA annually for 40 years you could turn 240000 into more than 1 million. As long as you earn income you can open an account. Get Up To 600 When Funding A New IRA.

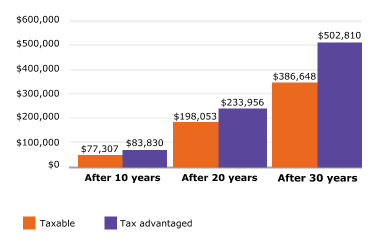

A Traditional SIMPLE or SEP IRA account can accumulate 82233 more after-tax balance than a Roth IRA account at age 65. A Roth IRA account can accumulate 180003 more than a regular. Build Your Future With a Firm that has 85 Years of Retirement Experience.

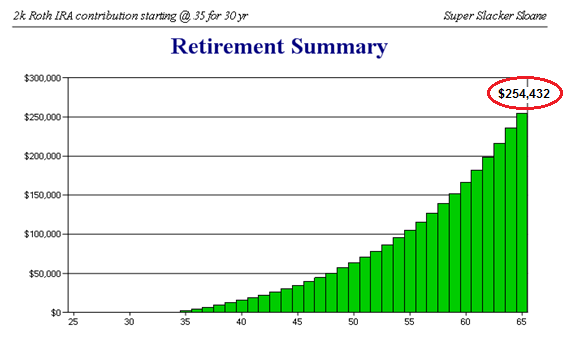

Age at which you plan to retire. Average Roth Ira Balance By Age Overview Average Roth Ira Balance By Age A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership. Target Roth IRA balance by age.

In 2020 and beyond as a result of the SECURE Act there is no maximum age at which you can. Balance Accumulation Graph Roth IRA Regular. Reviews Trusted by Over 45000000.

The Roth IRA can provide truly tax-free growth. Visit The Official Edward Jones Site. Refine Your Retirement Strategy with Innovative Tools and Calculators.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. This calculator assumes that. New Look At Your Financial Strategy.

Roth IRA income limits will differ for. Thats what a fund of funds looks like. Target Roth IRA balance by age.

Get Up To 600 When Funding A New IRA. Ad Explore Your Choices For Your IRA. Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need.

Roll Over Into A TIAA Roth IRA Get A Clearer View of Your Financial Picture. Youll owe taxes and possibly a 10 penalty if you withdraw the investment earnings before age 59½ or if. The average and median individual IRA balance increased with age before leveling off for those age 70 or older.

Roth Ira Balance By Age Overview. Roth Ira Balance By Age A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the. There are no age limits to open a Roth individual retirement account Roth IRA.

1 2024 to withdraw your Roth IRA. Explore Choices For Your IRA Now. Again thats in contrast to a traditional IRA which mandates required minimum.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. According to provided information the Roth IRA account can accumulate 240004 more than a regular taxable savings account by age 65. Prior to 2020 the maximum age limit to contribute to a traditional IRA was 70 12.

Roth IRA Calculator. 2 As a minor parents will have to open. A 2055 fund is going to be a lot more heavily heavy in the direction of stocks.

Ad Open an IRA Explore Roth vs. Traditional or Rollover Your 401k Today.

Ira Information Types Of Iras Traditional And Roth Wells Fargo

What Is The Best Roth Ira Calculator District Capital Management

Contributing To Your Ira Start Early Know Your Limits Fidelity

What Is The Average 401k Balance By Age See How You Compare Dollar After Dollar

Who Uses Individual Retirement Accounts Tax Policy Center

Roth Ira Calculators

How Much Should I Have Saved In My 401k By Age

Starting A Roth Ira For A Teenager Action Economics

How Much Should I Have Saved In My 401k By Age

Who Uses Individual Retirement Accounts Tax Policy Center

The Difference In Retirement Savings If You Start At 25 Vs 35

Roth Ira For Kids Make Your Grandchildren Millionaires Retireguide

What Is A Roth Ira Money Com

Roth Ira Calculators

:max_bytes(150000):strip_icc()/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

Financial Planners Have You Heard About The Roth Ira Movement Moneytree Software

Why The Median 401 K Retirement Balance By Age Is Dangerously Low