Max 401k contribution 2021 calculator

Use the Self-Employed 401k Contributions Comparison to estimate the potential contribution that can be made to an Individual 401k compared to Profit Sharing SIMPLE or SEP plan. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

The Maximum 401k Contribution Limit Financial Samurai

Ad Maximize Your Savings With These 401K Contribution Tips From AARP.

. Plan For the Retirement You Want With Tips and Tools From AARP. In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can. A 401k plan and a profit sharing plan can be combined with a.

10 Best Companies to Rollover Your 401K into a Gold IRA. Use the interactive calculator to calculate your maximum annual retirement contribution based on your income. A limit applies to the amount of annual compensation you can take into account for determining retirement plan contributions.

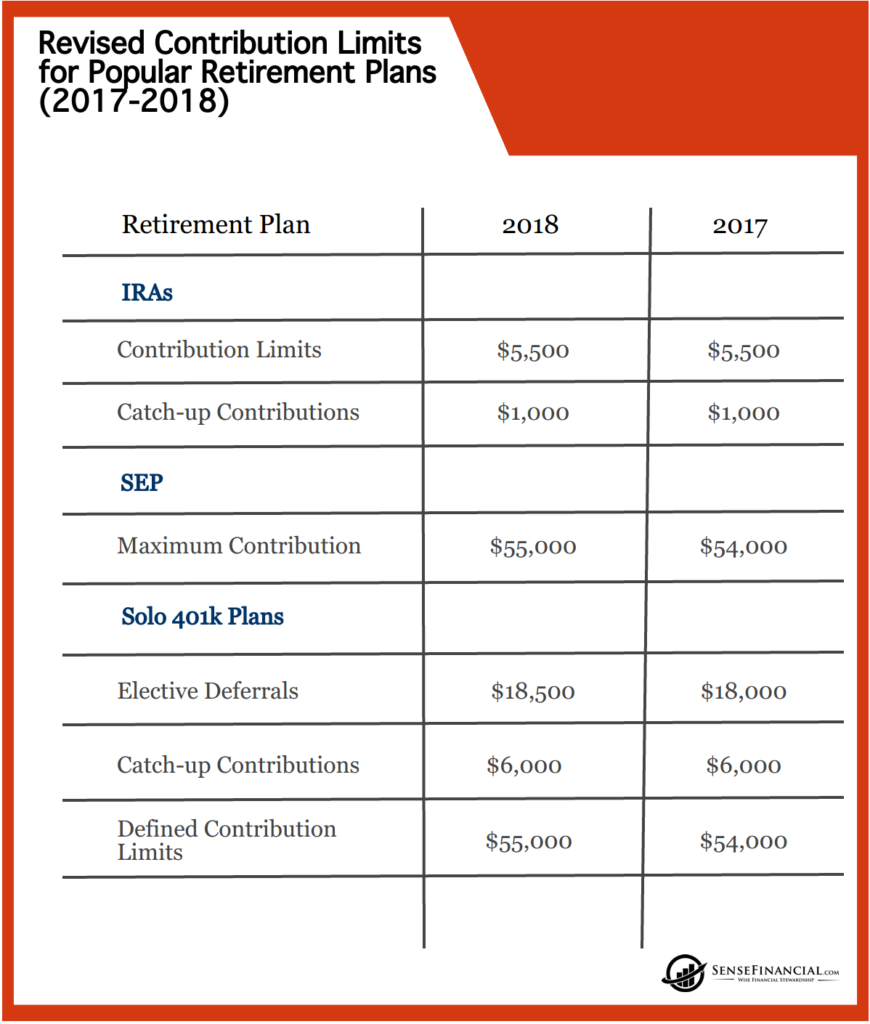

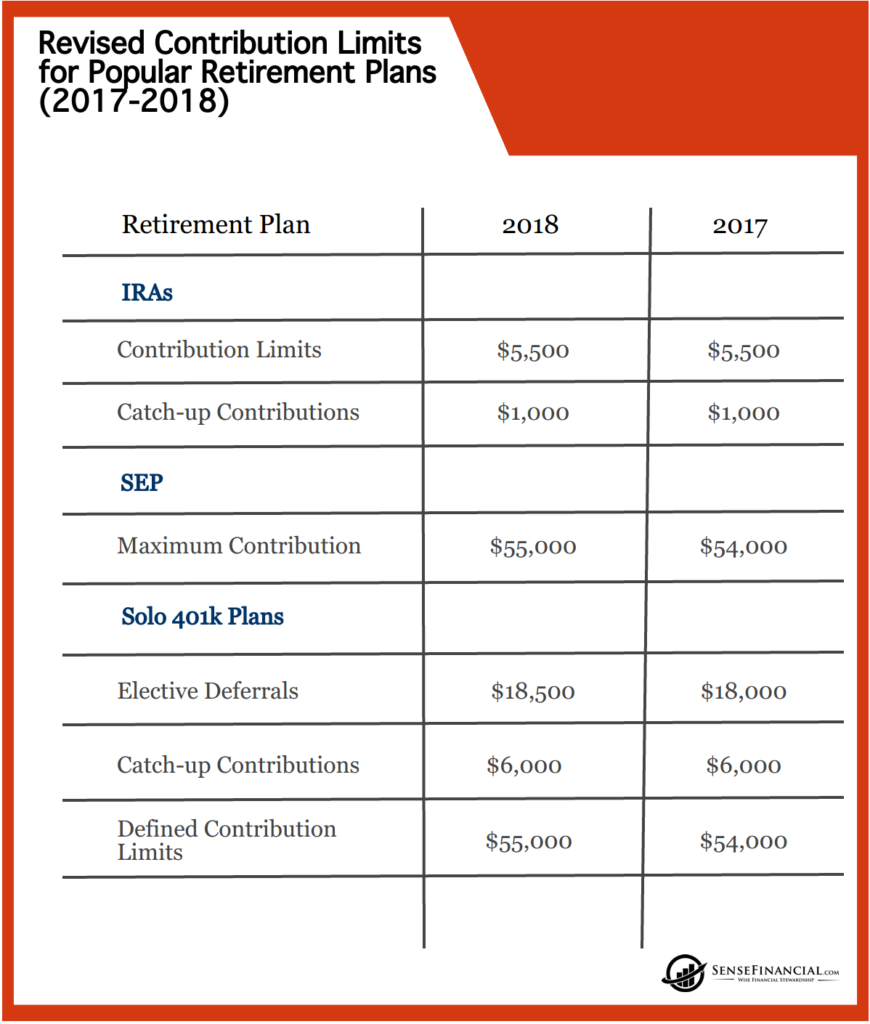

This limit is 305000 in 2022 290000 in 2021. A Solo 401 k. If permitted by the 401 k plan participants age 50 or over at the end of the calendar year can also make catch-up contributions.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Your retirement strategy should begin with a tax-advantaged retirement account but it doesnt have to end there. Ad See How Transferring to a Fidelity IRA Can Help Simplify Your Finances.

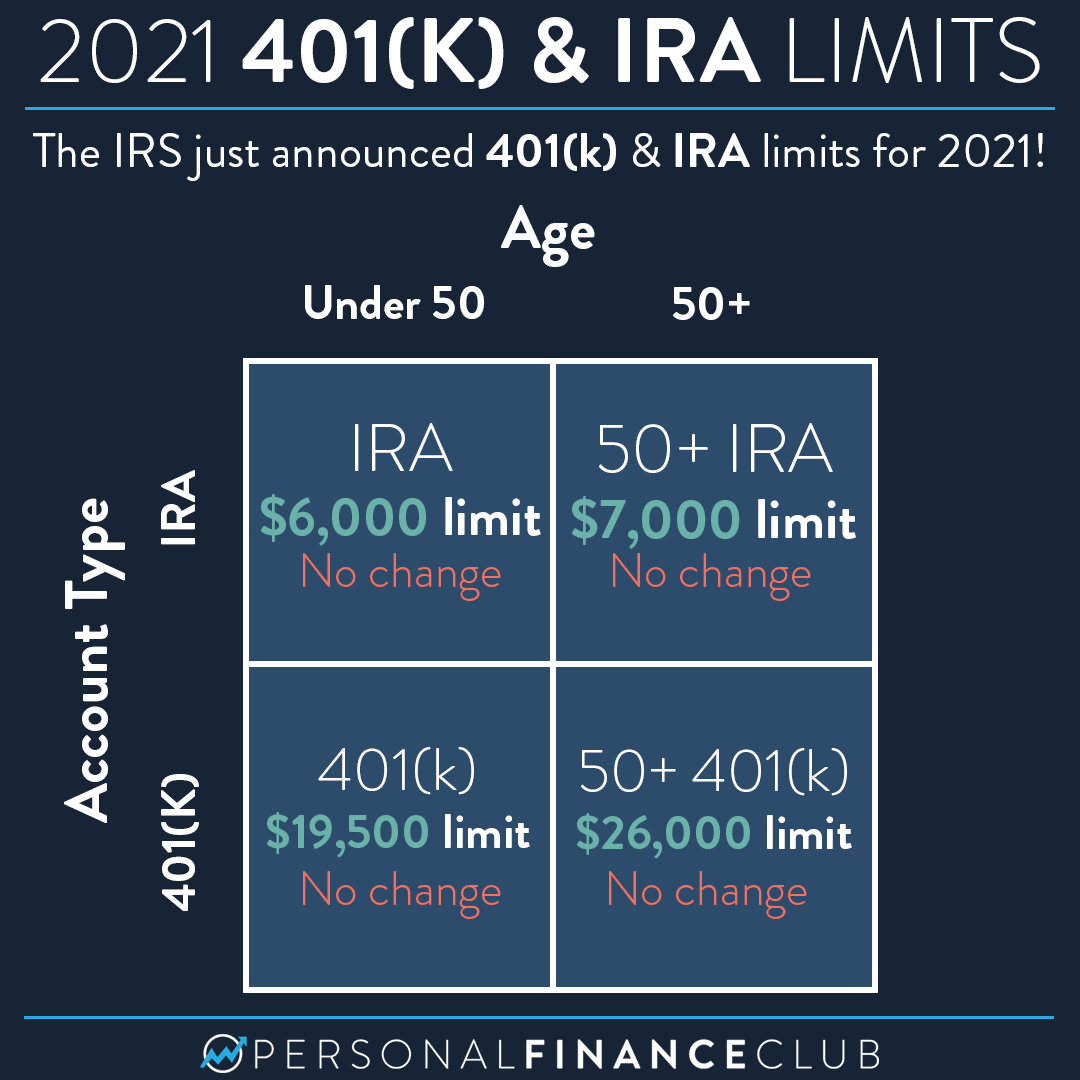

Protect Yourself From Inflation. This limit increases to 67500 for 2022 64500 for 2021 63500 for 2020 if you include catch-up contributions. Specifically you are allowed to make.

For those age 49 and under the limit is 61000 in 2022 up from 58000 in 2021. Solo 401k Contribution Calculator. After not being able to find any calculator or formula online for what I was looking for I decided to sit down and create my own.

Anyone age 50 or over is eligible for an additional catch-up. Simply enter your name age and income and click Calculate The result will. Help Your Employees Plan For the Future With Our Integrated Benefits Solution.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Employer 26934 max solo. Solo 401k contribution calculator for the self-employed and side hustlers.

Explore The Advantages of Moving an IRA to Fidelity. This calculator below tells you what percentage. An employee contribution of for An employer.

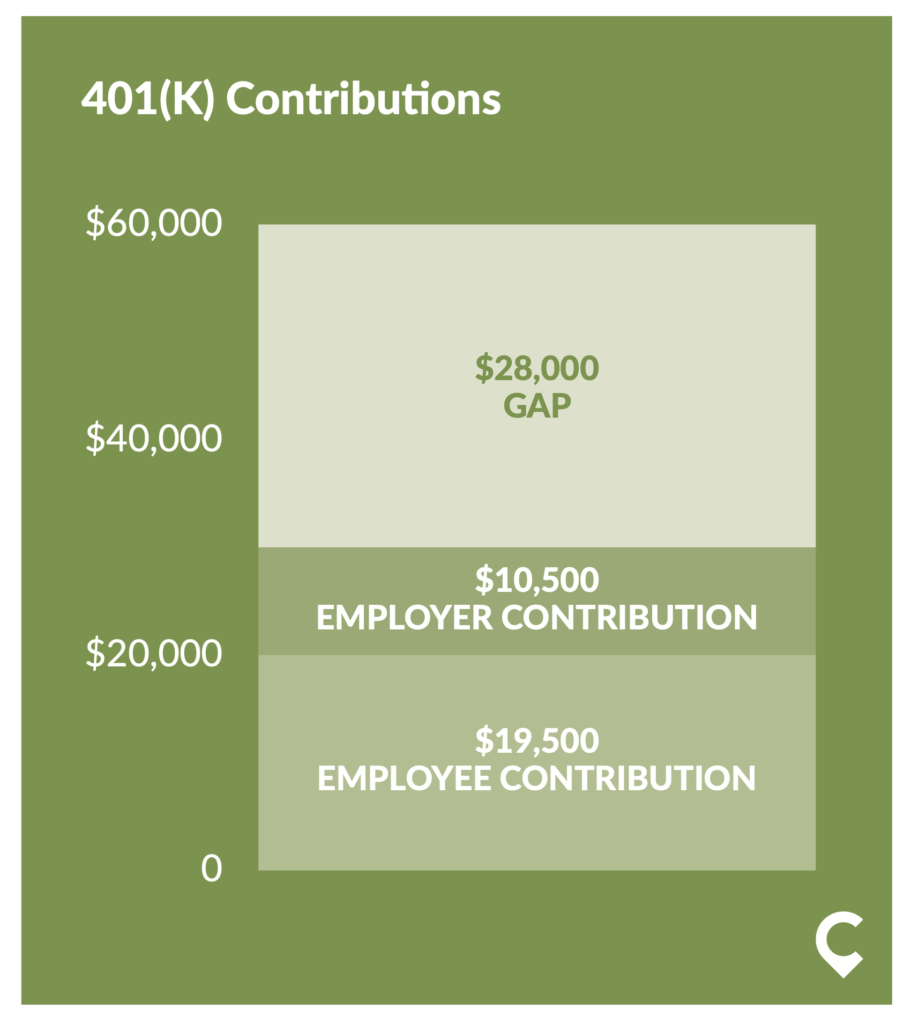

For 2022 the 401k limit for employee salary deferrals is 20500 which is above the 401k 2021 limit of 19500. Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation. In addition the amount of your compensation that can be taken.

Employees can contribute up to 19500 to their 401 k plan for 2021 and 20500 for 2022. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit. Contributing to your 401k is a great way to prepare for retirement allowing for tax-deferred growth and in some cases employer matching contributionsIf you really want to.

Includes employee employer catchup and after-tax contributions. There is an upper limit to the combined amount you and your employer can contribute to defined 401 ks. Protect Yourself From Inflation.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Consider a defined benefit plan if you want to contribute more than the 2022 Individual 401k contribution limit of 61000. Employer matches dont count toward this limit and can be.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. 10 Best Companies to Rollover Your 401K into a Gold IRA. Supplementing your 401k or IRA with cash value life insurance can help.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. You may contribute additional elective. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer.

After Tax Contributions 2021 Blakely Walters

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

401k Employee Contribution Calculator Soothsawyer

How Much Should People Have Saved In Their 401ks At Different Ages See More At Http Www Financialsamura Saving For Retirement 401k Chart Finance Education

401k Contribution Calculator Step By Step Guide With Examples

Infographics Irs Announces Revised Contribution Limits For 401 K

Making Year 2021 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Backdoor My Solo 401k Financial

401k Contribution Calculator Step By Step Guide With Examples

Employer 401 K Maximum Contribution Limit 2021 38 500

The Maximum 401 K Contribution Limit For 2021

401k Contribution Limits And Rules 401k Investing Money How To Plan

Solo 401k Contribution Limits And Types

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Contribution Calculator Step By Step Guide With Examples

2021 Contribution Limits For 401 K And Ira Personal Finance Club

Excel 401 K Value Estimation Youtube

Your Guide To The Mega Backdoor Roth Case Study Free Flow Chart